When looking into how much visitor health insurance costs in the USA, it’s a good idea to break it down daily. When you look at it this way, visitor health insurance is very cheap; you could be looking at paying as little as a dollar a day, depending on your age and coverage extent. A whole week of minimum coverage could cost less than $5. However, if you want the best option available, you could pay more than $100 per week.

There is no one-size-fits-all cost for visitor health insurance plans. It differs between limited and comprehensive plans. Details like your age, the number of days you need coverage for, the deductible, and the policy maximum determine the amount of your premium.

Visitor Insurance Plans | Plan Medical Limit | Plan Cost* |

|---|---|---|

Safe Travels Elite | $ 25,000 maximum | $28 per month |

Visitors Care | $ 25,000 maximum | $29 per month |

Safe Travel Comprehensive | $ 50,000 maximum | $110 per month |

Safe Travel Comprehensive | $100,000 maximum | $136 per month |

Venbrook Premier |

| $74 per month |

Here’s a sample premium for a 25-year-old with a $50,000 limit and a $250 deductible:

If your family is coming to visit you soon, it’s a brilliant idea to investigate how much travel insurance costs and how to get it. If you want visitor health insurance for your parents, consider Patriot America Plus. With maximums of up to $500,000, low deductible options, and an expansive network of available health providers, it’s an excellent choice for those 50 years of age or older. It even offers coverage for acute onset of non-chronic pre-existing health conditions for those under 70.

Medical Insurance Plans | Plan Limit | Deductible | Plan Cost* |

|---|---|---|---|

Safe Travels Elite | $ 25,000 maximum | $0 | $34 per month |

Visitors Care | $ 25,000 maximum | $100 | $27 per month |

Safe Travel Comprehensive | $ 50,000 maximum | $250 | $124 per month |

Patriot America Plus | $50,000 maximum | $250 | $125 per month |

Venbrook Premier | $50,000 maximum | $250 | $74 per month |

Atlas America | $50,000 maximum | $250 | $135 per month |

The costs for your parents’ insurance plans can vary, depending on how much coverage you think they’ll need for their visit. If they decide to go with Patriot America Plus, for example, their maximum limits will range anywhere from $50,000 to $1,000,000, and their deductible will be between $0 and $2,500 depending on the plan you choose. If you decide to get your parents a deductible of $0 and a maximum limit of $50,000, then your premium will come out to around $6 (depending on the age) per day that they visit.

Purchasing travel insurance for your parents has never been easier. Medical exams are not typically required, and the paperwork is limited. Just be sure to have all personal information on hand when filling out an online application. Medical information is typically not needed for completing the application, but it is good practice to carry all your latest records while traveling.

Related Article: Travel Insurance for Parents Visiting the US 2025

If you need J1 Visa Health Insurance, we’ll help you find the perfect plan. And if your parents need visitor health insurance, call us at 804-325-1385.

If you know anything about the U.S. healthcare industry, you may be aware of the rising costs of medical care. Without adequate travel insurance coverage, medical issues can lead to serious financial problems. There’s no need to put yourself and your family at risk. In most instances, travel health insurance will take care of basic healthcare costs. When you sign up for travel insurance, you are securing coverage for countless health benefits, including hospitalization, doctor visits, prescription drugs, tests, x-rays, and even the acute onset of pre-existing conditions (sudden and unexpected recurrence or flare-up of a previously diagnosed condition).

The average cost of the USA travel insurance starts from 16$ per month. It depends on several factors. In this article, we will break down the cost of coverage, from premiums and deductibles to policy maximums and treatment payments.

In general, visitor health insurance will cost less if you:

The premium depends on your age, the coverage duration, medical maximum, deductible amount, and plan type. When you choose low maximum coverage, your monthly or weekly premium will be much less than it would be if you wanted a limit of $100,000 or more. In the case of a serious medical emergency, $25,000 may only get you so far. You could end up owing tens of thousands of dollars should you fall ill or suffer a major injury that requires surgery.

When you choose a higher deductible, it will lower your premium. This amount is usually higher than the deductible required in comprehensive health plans. For a fixed/limited benefit plan, in the event of a surgery, you would pay a deductible, as well as any difference between the covered maximum and the actual cost. In the case of surgery, you would pay a high deductible, as well as any difference between the covered maximum and the actual cost.

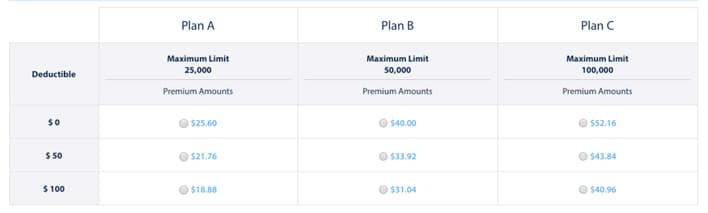

Here’s a look at how deductibles and premiums may vary according to your selections.

The table shows possible options for a Visitors Care fixed benefit plan. As you can see, higher deductibles equate to lower premium amounts. Also, the higher the maximum coverage limit, the higher the premium. Visitors Care offers a $40 max for physician visits and $200 max for a hospital emergency room visit.

If you are young, healthy, and traveling for just a short period of time, the cost savings might make sense for you—so long as you are partaking in low-risk travel. If you are older and have had any serious medical issues in the past, such plan options might put you at physical and financial risk. Just be sure to keep the maximum coverage limits in mind when deciding what the best option for you is.

If you can afford to pay a higher premium for more comprehensive coverage, consider Atlas America or Patriot America Plus. Both plans provide excellent visitors insurance in the USA. For individuals under the age of 30, Atlas America starts as low as $0.77 a day, or roughly $5 a week. Of course, these numbers coincide with less coverage. Your deductible would be $5,000 for a major medical expense, with a maximum coverage limit of $50,000. As a traveler of 80 or older, the maximum premium would amount to around $13 per day.