Health insurance for foreigners and non-citizens in the USA. [2025 Guide]

At Visitor Guard®, we specialize in providing comprehensive health insurance for foreigners and non-citizens visiting the USA. We offer a wide range of insurance options, including visitor health insurance for parents and relatives visiting the USA, student travel insurance for international students pursuing higher education in the country, and affordable health insurance for non-residents.

Visitor Guard® has carefully curated an extensive selection of visitor health insurance policies designed to cover medical expenses for foreign nationals during their visit in the USA. Our affordable and flexible plans are tailored to meet the unique needs and travel schedules of non-residents.

Having reliable medical insurance for foreigners in the USA benefits both visitors and their hosts by helping to prevent unforeseen medical expenses. Fill out the form on this page to get free quotes and choose a health insurance plan that best fits your needs and budget.

Get Quote Now

Comprehensive Health Insurance Plans for Foreigners in the USA

Safe Travel USA Comprehensive

$73 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19, Well Doctor Visit

- Coverage for 1 episode of Acute Onset of Pre-existing conditions

- Coverage from 5 days to 364 days

- Brochure

Patriot America Plus

$75 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $2,500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Atlas America

$79 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $2 million

- Deductible options from $0 to $5,000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 364 days

- Brochure

Venbrook Basic

$68 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1000,000

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, ADD

- Coverage from 5 days to 365 days

- Brochure

- Review Plan

Venbrook Premier

$74 / mo For age 45 years with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1000,000

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid 19

- Coverage for Acute Onset of Pre-existing conditions up to age 69

- Coverage from 5 days to 364 days

- Brochure

- Review Plan

Patriot America

$73 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $2,500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Patriot Platinum

$167 / mo For age 45 year with $2 million plan and $250 deductible- Plan maximum limits ranging from $1 million to $8 million

- Deductible options from $0 to $2,500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Limited Benefits Health Insurance Plans for USA for Foreigners

Visitors Care Insurance

$31 / mo For age 45 year with $50,000 plan and $100 deductible- Plan maximum limits ranging from $25,000 to $100,000

- Deductible options of $0, $50, $100 (varies by age)

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Safe Travels Elite

$38 / mo For age 45 year with $50,000 plan and $0 deductible- Plan maximum limits ranging from $25,000 to $170,000

- Deductible options $0; For ages 79 to 89 yrs: $100, $200

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for 1 Acute Onset of Pre-existing conditions

- Coverage from 5 days to 364 days

- Brochure

Advantages of Health Insurance for Foreigners in the USA

Visiting or living in the US can be a new and sometimes challenging experience, especially when it comes to healthcare costs. Getting insured before visiting offers several advantages:

- Comprehensive Medical Coverage - Health insurance for foreigners covers medical and hospital bills, which otherwise can be prohibitively expensive in the US.

- Family Coverage: Some insurance plans offer coverage for non-US citizens visiting their families in the US.

- Coverage for international students-Studying in the US can be expensive, and health insurance helps manage unexpected medical expenses.

- Medical evacuation- Health insurance for foreign nationals safeguards you from unfortunate events and provides you with transportation to the nearest qualified medical facility in case of a medical emergency.

- Adventure sports coverage- Injuries from covered extreme sports can also be included in certain policies.

Why Choose Visitor Guard® for Health Insurance for Foreigners in the USA?

- Wide Range of Plans: We offer diverse health insurance options for students, visitors, and families, ensuring affordable and comprehensive coverage.

- 24/7 Support: Our dedicated team is available around the clock to address your questions and concerns.

- Expert Guidance: We help you select the right insurance plan based on your specific needs.

- Competitive Rates: We offer some of the most affordable health insurance rates in the market.

- Secure Purchase: We prioritize your privacy and ensure all transactions are safe and protected.

Best Health Insurance Plans for Foreigners in the USA

1. Venbrook Premier

Venbrook Premier is a leading travel medical insurance plan, tailored to provide coverage for non-US citizens travelling outside of their home country to visit United States, or any combination of the United States and other countries worldwide. The plan covers a certain amount for acute onset of pre-existing conditions up to 70 years. This comprehensive plan provides enhanced protection, ensuring coverage for a wide range of medical and travel-related emergencies.

2. Safe Travel USA Comprehensive

Safe Travel USA Comprehensive is a popular health insurance for foreigners in USA, it provides medical coverage to individuals and families traveling to the USA. It covers the acute onset of pre-existing diseases within a predetermined limit. The plan covers up to 100% up to the policy maximum for injuries or illnesses covered in the plan.

3. Atlas America Insurance

Known for its flexibility and dependability, this plan offers deductibles from $0 to $5,000 and policy maximums from $50,000 to $2,000,000. Atlas America insurance covers acute onset of non-chronic pre-existing conditions and includes benefits like emergency medical evacuation and adventure sports coverage.

4. Patriot America Plus

This plan covers up to 100% of the chosen policy maximum for the acute onset of non-chronic pre-existing conditions for people under the age of 70 years. Patriot America Plus has policy maximum options ranging from $50,000 to $1 million. One of the most rated and best-selling plans in this category,it offers excellent support and flexibility for travel changes.

Health Insurance for Non-Residents and Immigrants in the USA

Medical care in the US is expensive, and only a portion of the population receives public healthcare. n Foreigners visiting for short stays, work, study, or leisure often need private health insurance, as they are not eligible for federal programs like Medicare (typically available for individuals above 65 years) and Medicaid (available for lower income citizens).

When foreigners travel to the USA for short stays, work, leisure travel, study, and more, they need to purchase health insurance that can cover them in the US even if they have a plan to cover them in their home country. They clearly do not fall under the federal Medicare and Medicaid program.

Employers, educational institutions, or sponsorship organizations may offer coverage, but you can consider health insurance for foreigners as an alternative insurance if it meets the requirement.

How Much Health Insurance Coverage do Foreigners Need in the USA?

For many foreigners, life in or a visit to the US presents an entirely unique experience. However, one of the biggest challenges is the complex healthcare system. It is recommended that foreigners purchase a health insurance policy that can save them from extreme financial losses during medical emergencies.

From limited or fixed to comprehensive plans, travelers can find many options in the market. Buying a policy is a personal decision for many, however, there are many rewards associated with purchasing a plan. So, if you are wondering how much you should pay for medical coverage, the answer is mostly dependent on your health, risk tolerance, and budget.

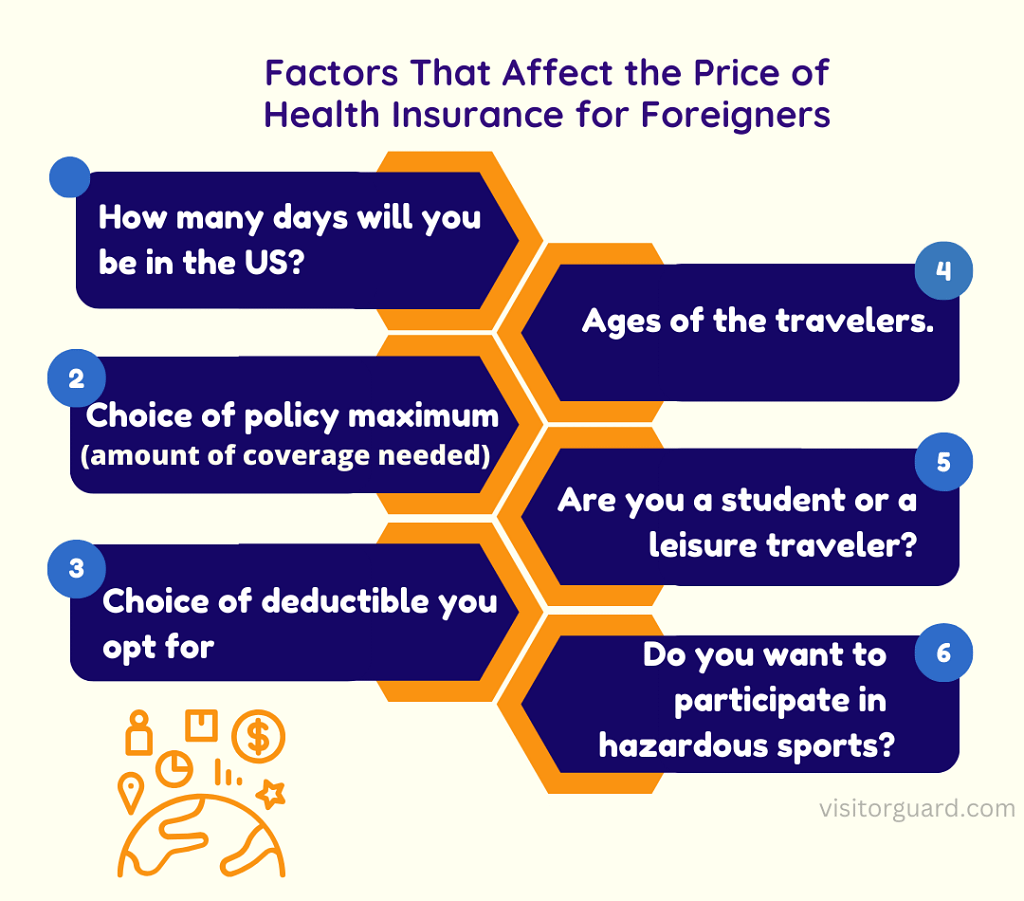

Generally, a few factors determine the cost of coverage, like the length of stay in the US, your age, deductible, and policy maximum you opt for. But these factors are overruled if you are willing to take health risks in a foreign land.

Factors Influencing the Cost of Coverage Include:

- Length of stay: Short visits may need lower coverage, while longer stays require more comprehensive plans.

- Age: Older travelers often face higher premiums.

- Amount of Coverage: Higher the policy maximum, typically you will pay a higher premium.

- Deductible: Premium typically are lower for higher deductibles

- Risk tolerance: More extensive coverage minimizes out-of-pocket expenses in case of emergencies.

If paying out-of-pocket medical expenses does not concern you, you can opt for a limited coverage policy bringing your upfront cost on the premium lower.

Some suggested coverage levels:

- 1 week to 1 month: $50,000 to $100,000

- 1 to 3 months: $100,000 to $500,000

- 3 to 12 months: $250,000 to $500,000

- 1 year or longer: $5 million to $8 million

It really depends on what illness/injury might occur and what you will be treated for, that will determine the amount of coverage you would need. A $50,000 plan might be enough for a flu but not be enough for hospitalization for a heart attack. No matter how long you plan to stay in the country, ensure that, you have plans with adequate coverage that can protect you throughout your stay. Owing to the expensive medical treatment in the US, an insurance policy may give you the comfort and peace of mind that you deserve.

Can you get Health Insurance if you are not a US Citizen?

Yes, foreigners can purchase health insurance in the USA. While non-residents and temporary visitors cannot buy insurance through the Health Insurance Marketplace, they can obtain coverage through private providers like Visitor Guard®. We offer a range of plans for leisure travelers, international students, business visitors, and even green card holders. Qualified immigrants may be eligible for medical coverage under Medicaid and Children’s Health Insurance Program (CHIP), but that completely depends on the income and residency rules of each state.

Non-immigrant Health Insurance USA

All overseas visitors to the United States are advised to purchase health insurance policies. Visitors who arrive in the US for a brief visit are considered non-immigrants. They can spend time with their families, go on a vacation, or attend a business meeting. Regardless of the reason, medical insurance plans come in handy because this can avoid many unforeseen medical expenses in the event of sickness.

You are considered a visitor when you have a non-immigrant status in the US. Visitors cannot access domestic plans or government-sponsored programs. However, they can buy plans from private insurance providers, like us, Visitor Guard®. There are numerous comprehensive and fixed-benefit plans suited for every category of travelers.

How Much Insurance Coverage is Needed for a Foreigner in the USA?

Healthcare cost in the US varies by sickness, procedure, and facility. For instance, the cost of removing kidney stones will cost you higher than getting treated for mild viral fever. Nevertheless, the medical bills for any treatment can be expensive. This is where your choice of policy will play a vital role.

It is exceedingly difficult to say how much coverage is needed. However, you can consider the following factors to determine the amount of coverage you might need in the US. How long will you be staying in the US?

- Do you have any medical condition?

- What is your age?

- Do you want optional coverage?

- What is the nature of your stay in the US?

- Do you wish to take part in extreme sports?

It is entirely up to foreigners purchasing insurance in the United States to decide how much risk they are willing to take and how much they are willing to pay based on their health, the type of stay, the length of stay, and other factors. Policy maximums range from $50,0000 to $5 million. To find out exactly what type of policy best fits your needs, get in touch with Visitor Guard®.

Health Insurance for Foreign Nationals in USA - Cost

Health Insurance for Foreign Nationals is a type of insurance policy which provides coverage to the foreign nationals visiting the US. Purchase reasonably priced foreign national insurance in the USA from one of our many plan options. Foreign nationals' health insurance premiums vary widely. Venbrook Premier, Patriot Travel, Atlas Travel, and Safe Travels USA Comprehensive are among the comprehensive plans. On the other hand, Safe Travel Elite and Visitor Care Insurance are examples of limited plans.

The Limited benefit plans are less expensive than the comprehensive plans, but certianly provide limited coverage thanthe comprehensive plans. There are different choices of plans. The higher the coverage you choose, the higher is the premium.

For instance, Safe Travels USA Comprehensive includes coverage for an acute onset of pre-existing conditions up to a predetermined limit and per the age of the traveler but adventure sports is an optional coverage that can be included for an additional premium. On the other hand, Atlas America has adventure sports coverage included in the coverage. Hence, the premium will vary based on what you opt for.

Venbrook Premier, Safe Travel USA Comprehensive and Patriot America have plan maximum limits ranging from $50,000 to $1 million with a $77, $90 and $77 premium for a 45-year-old individual for a $50K plan and $250 deductible.

Atlas America plans maximum limits are $50,000 to $2 million with an $80 premium for a 45-year-old individual, and Patriot Platinum offers $1 million to $8 million with a $146 premium for a 45-year-old individual.

The limited plans are cheaper. The Visitor Care Insurance and Safe Travel Elite plan maximum limits range from $25,000 to $100,000 ($175,000 for the Safe Travel Elite) with an approximate $30 premium each for a 45-year- old individual. If policyholders add optional riders the premium of the policy will be higher depending on the optional rider you add.

Know about Health Insurance for Foreigners in the USA and the ACA Penalty

The Affordable Care Act (ACA), also known as Obamacare, was launched by President Obama a decade back. The aim was to make sure all US citizens and residents have access to quality and reasonable health insurance in the US.

The visitors to the US are not eligible for Obamacare as they are not residents of the US, and they do not file tax returns in the US. They are exempt from any penalty. However, individuals with non-immigrant status, including worker visas (such as H1, H-2A, H-2B), student visas, U-visa, T-visa, and other visas can apply for ACA status.

Since 2019, there is no shared responsibility (penalty) for uninsured individuals, however, there are some states in the country where penalties still apply for the uninsured. Some of the states that have implemented their own mandate and penalties are Massachusetts, California, New Jersey, Rhode Island, and Washington D.C.

Health Insurance Coverage for Non-US Citizens in the USA

If you are an expatriate living in America, it is wise to get health insurance for non-residents in the USA that can cover you throughout your stay. Always make sure that the policy covers medical evacuation, emergencies, sudden repatriation, accidents, dental, and more.

If you wish to stay in this country for a year, make sure that the plan covers everything that you may need for a year. If you need to stay for a few months, you can choose some basic plans, covering illnesses, injuries, accidents, and doctor's visits.

Are you confused on what to choose? We are here to help. Visitor Guard® has some of the best plans for health insurance for foreigners, suitable for immigrants, students, travelers, au pairs, professors, and more.

Health Insurance for Foreigners - FAQs

Yes, foreigners can definitely buy health insurance in the USA. It is highly recommended to purchase insurance before arriving, ensuring coverage from the moment you start your journey. Medical expenses in the US are notoriously high, and without insurance, even minor treatments can become costly. Visitor Guard® offers a wide range of plans tailored to cover medical emergencies, routine care, and unexpected health issues.

The cost of health insurance for foreigners varies based on several factors, including the traveler’s age, duration of stay, coverage limits, and chosen deductible. Plans can range from as low as $20 per month to $142 or more per month for a 45-year-old individual. Generally, comprehensive plans offer broader coverage and higher policy limits, while limited benefit plans provide more basic protection at a lower cost.

Non-US citizens have several health insurance options depending on their visa type and status. Visitors, students, and temporary residents can choose private health insurance plans designed specifically for foreigners. Long-term residents, green card holders, and those on work visas may qualify for domestic insurance plans like Blue Cross Blue Shield, Aetna, and Cigna, provided they can show proof of lawful presence.

Only specific non-citizens can purchase health insurance through Obamacare (Affordable Care Act). To be eligible, you must be a green card holder, a lawful permanent resident, or meet other qualifying immigration statuses. Temporary visitors and tourists are not eligible for Obamacare but can obtain private insurance plans designed for short-term stays.

Yes, tourists should strongly consider foreigner health insurance when visiting the USA. The high cost of medical care makes insurance an essential safeguard against unexpected illnesses or injuries. Visitor health insurance plans offer coverage for emergency treatment, hospital visits, and urgent care, ensuring tourists avoid significant out-of-pocket expenses.

Coverage needs vary based on the length of stay and personal health risks. For short-term stays of 1 to 3 months, coverage between $100,000 and $500,000 is typically sufficient. For longer visits, plans offering at least $250,000 in coverage are advisable. Though these are just suggestion, foreigners travelling to the US, must decide on how much coverage they prefer based on their health, requirements, and budget.

Yes, non-immigrant status can get insurance from private companies. These plans may not provide coverage like domestic plans but will surely keep you financially safe during your trip to the US. Depending on your chosen plan, you will receive coverage for medical bills, hospital charges, prescription drugs, medical evacuation, COVID-19 treatment, repatriation, AD&D (Accidental Death & Dismemberment), and more. Check the brochure to know what your plan covers and what it does not.

As of 2019, there is no federal mandate for health insurance for residents. However, states like California, Massachusetts, and New Jersey still impose penalties for uninsured residents. Despite no federal requirement, health insurance is highly recommended to avoid financial risk. For foreigner visiting the US, there is no mandate. Healthcare costs in the USA are exceedingly high. When traveling to the US unexpected medical events can result in high out of pocket expenses. We would recommend getting health insurance before traveling to the USA.

The best health insurance for foreigners in USA is the one that has the highest medical expenses coverage, including some coverage for acute onset of pre-existing conditions and COVID-19.. Most of the plans we offer will fulfill your needs.

But, to name a few of the best ones they are: Venbrook Premier, Safe Travels USA Comprehensive, Patriot America Plus, Atlas America and Patriot Platinum America.

Yes, non-US citizens can get health insurance. Green card holders, residents, and those on work visas can access domestic plans like Blue Cross Blue Shield, Aetna, and Cigna by providing proof of legal status, such as a Social Security number. Visitors can choose from a variety of health insurance plans for foreigners designed specifically for temporary stays.

Yes, expats need US health insurance due to the high cost of medical care. Proper coverage helps prevent financial strain and ensures access to high-quality medical treatment in case of illness or injury.

No. Visitor insurance does not cover general ENT check-ups. The plans cover new complications, illnesses, or wounds that can occur during your travel. These plans will not cover regular check-ups, doctor follow-ups, and prescriptions. If Depending on the plan you have, if you need medical attention for something new that happens while already traveling the plan can offer coverage. However, to know what your plan covers, do check the brochure.

Yes, you can buy plans for senior foreigners who are 75 years of age. However, make sure you buy a plan that meets their medical and travel requirements. Senior travelers need to pay higher premiums for health insurance because of the health risk associated with them. Furthermore, these plans offer limited policy maximum options and limited acute onset of pre-existing coverage. It is good practice to check the policy brochure before going ahead.

Many international student plans can cover maternity and pregnancy. However, some health insurance plans for visitors include some coverage for complications in pregnancy up to 26 weeks. Visitor plans for foreigners coming to the US typically exclude maternity, pregnancy, abortion, delivery, and coverage linked to pregnancy. If you are pregnant and wish to visit the US, depending on your plan, it can cover complications as defined by the plan that may occur during travel. You must bear all the medical costs if your plan excludes maternity and pregnancy.

It is generally advised to purchase insurance before traveling to the United States since, if the application date coincides with the departure date and you have already left your home country, you can be protected as soon as you begin your trip and as per the date on the application. Due to the high cost of healthcare in the United States, out-of-pocket expenses might amount to hundreds or even thousands of dollars. In these situations, a health insurance plan can be helpful. Tourists must purchase insurance plans that will cover them in the US for the duration of their short stay because they are unable to access government-sponsored insurance programs. Although it is advised to purchase early, you can purchase a plan after arriving in the United States.