Visitor Insurance for Pre Existing Conditions

Are you planning a trip to the United States soon? Well, who doesn’t love traveling unless you have to come across situations where you have no other option but to spend a lot. Yes, especially if you are traveling with pre-existing conditions. But that shouldn’t stop you from doing what you want! Get your visitor insurance for pre existing conditions today!

With visitor insurance for pre-existing conditions, you can travel safely with a pre-existing condition, provided you are cleared by your doctor. All you need is to purchase visitor insurance for pre-existing conditions that best suits your needs.

Differentiating between health insurance plans that cover pre-existing conditions and choosing the right one can be hectic. Get in touch with Visitor Guard® to get the best visitor insurance plan that will cover almost all pre-existing conditions for visitors to the USA.

Contact Visitor Guard® to get your visitor insurance with pre-existing conditions within few minutes.

Visitor Insurance with Pre Existing Conditions – Comprehensive Plans

Safe Travel USA Comprehensive

$73 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19, Well Doctor Visit

- Coverage for 1 episode of Acute Onset of Pre-existing conditions

- Coverage from 5 days to 364 days

- Brochure

Patriot America Plus

$75 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $2,500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Venbrook Premier

$74 / mo For age 45 years with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1000,000

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid 19

- Coverage for Acute Onset of Pre-existing conditions up to age 69

- Coverage from 5 days to 364 days

- Brochure

- Review Plan

Atlas America

$79 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $2 million

- Deductible options from $0 to $5,000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 364 days

- Brochure

Patriot Platinum

$167 / mo For age 45 year with $2 million plan and $250 deductible- Plan maximum limits ranging from $1 million to $8 million

- Deductible options from $0 to $2,500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Visitors Protect

$240 / mo For age 55 years with $50,000 plan and $250 deductible- Plan maximum limit options of $50,000, $100,000 and $250,000

- Deductible options from $250 to $5000 per incident

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for Pre-existing conditions

- Coverage from 90 days to 12 months

- Review Plan

- Brochure

Safe Travel USA

$62 / mo For age 45 year with $50,000 plan and $250 deductible- Plan maximum limits ranging from $50,000 to $1 million

- Deductible options from $0 to $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19, Well Doctor Visit

- Coverage for 1 episode of Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Visitor Insurance for Pre Existing Conditions - Limited Benefit Plans

Visitors Care Insurance

$31 / mo For age 45 year with $50,000 plan and $100 deductible- Plan maximum limits ranging from $25,000 to $100,000

- Deductible options of $0, $50, $100 (varies by age)

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for non-chronic Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Safe Travels Elite

$38 / mo For age 45 year with $50,000 plan and $100 deductible- Plan maximum limits ranging from $25,000 to $170,000

- Deductible options $0; For ages 79 to 89 yrs: $100, $200

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

- Coverage for 1 Acute Onset of Pre-existing conditions

- Coverage from 5 days to 2 years

- Brochure

Benefits of Visitor Insurance for Pre Existing Conditions

Your health should be a top priority but that should not stop you from planning an adventure travel trip! Traveling with pre-existing medical conditions has become easy with health insurance that covers pre existing conditions.

1. Saves money- Even though health care is expensive in the US, purchasing a Visitor Insurance for pre existing conditions will save you from making a hole in your pocket.

2. Trip Delay- Covers your trip delays to avoid huge monetary loss.

3. Loss of luggage- Your belongings are covered so that you don’t have to go through a huge loss.

4. Emergency evacuation- In case of severe illness, a medical insurance plan for pre-existing conditions can arrange transportation services to help you reach and get medical aid as soon as possible.

5. Covid-19 coverage- Covid-19 coverage- Insure yourself from all the medical bills that may arise due to covid-19 infections by purchasing Visitor Insurance for Pre Existing Conditions.

Why choose us for Visitor Insurance for Pre Existing Conditions?

Choosing the right health insurance that covers pre-existing conditions can be tough and you might need to invest a lot of time too. Fortunately, not anymore! Visitor Guard® is here to help.

1. Not geographically limited- We offer services to visitors all over the world.

2. Exceptional customer service- We offer support to our customers 24*7.

3. Best rates- Compare between the best prices available and get what fits your budget.

4. Smooth purchase- Buy medical insurance for pre existing conditions hassle-free with Visitor Guard®. We make sure you are able to make quick purchases.

5. Help after purchase- We will make sure you don’t face problems alone and remind you before your plan expires.

Best Visitor Insurance for pre existing conditions for USA

1. Safe Travel USA Comprehensive

Safe Travels USA Comprehensive s a travel medical insurance plan for pre existing conditions that covers Non- US Citizens and Non-US Residents while visiting the USA. The plan provides acute onset of pre-existing conditions coverage and covers one Well Visit per policy. The rates of this visitor insurance for pre existing conditions are based on age, policy maximum, and deductible choice. The plan also covers covid-19 as any other illness.

2. Atlas America

Atlas Travel insurance is the best visitor insurance for pre existing conditions for USA.

This is a comprehensive visitor insurance for pre existing conditions that covers Non-US citizens and Non-US residents while visiting the US. The plan provides acute onset of non-chronic pre-existing conditions coverage. The plan also has limited coverage for complications due to pregnancy per the schedule of benefits. Rates are based on age, duration, policy maximum, and deductible choice.

3. Patriot America Plus

Patriot America Plus Travel insurance is a comprehensive visitor insurance plan for pre-existing medical conditions that covers individuals outside their country of residence. The plan provides acute onset of non-chronic pre-existing conditions coverage for individuals below the age of 65 years. Rates are based on age, duration, policy maximum, and deductible choice.

Get Quote Now

Visitor Insurance with Pre-Existing Medical Conditions Coverage

Traveling to the United States can sound great. But it might not be that great if you are traveling with pre-existing conditions. Why? Because you are going to lose a lot of money in case of an acute onset of those conditions. It is important to understand what medical insurance plans for pre-existing conditions you will need and purchase accordingly before your trip.

Pre-existing condition refers to any medical condition that has occurred within 120 days prior to the purchasing date including the date itself.

Reasons you should consider purchasing medical insurance for pre-existing conditions

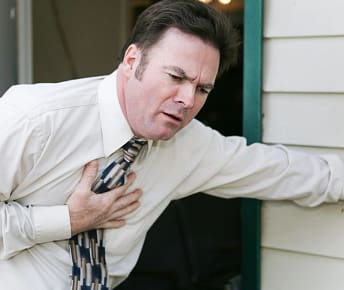

- You suffer from heart disease, high blood pressure, diabetes, cancer, etc.

- Conditions like arthritis, flu, or shingles have occurred within the look-back period.

- Occurrence of any symptoms.

- Gone through diagnosis and treatment by a doctor

Do Visitor Insurance Plans cover Pre-Existing Conditions?

Yes! Visitor Insurance plans cover acute onset of Pre-Existing Conditions, you just need to find the right medical insurance plan for pre-existing conditions. Most Visitors Insurance Plans do not cover Pre-Existing Conditions however there are plans covering for acute onset of pre-existing medical conditions up to a limit.

The definition of a pre-existing medical condition differs from insurer to insurer. But, most visitor health insurers state that a pre-existing condition is a medical condition that existed at the point of or before buying travel insurance.

Pre-existing Medical Conditions for Visitor Insurance

- The most common Pre-existing Medical Conditions for which you should purchase health insurance that covers pre-existing conditions include heart disease, cancer, high blood pressure, high cholesterol, diabetes, breathing conditions, kidney conditions, arthritis, stroke, epilepsy, liver conditions, or psychological conditions including depression and anxiety. Listing all medical conditions would be impossible and it would be wise to say if it exists at the time of application it will be considered a pre-existing condition. The Visitor medical insurance coverage for pre-existing conditions is quite limited and is extended to a small number of pre-existing conditions only.

- Pre-existing conditions for visitor health insurance, are defined as any illness, disease, injury, or other types of the medical condition for which you sought medical advice, received a diagnosis, experienced symptoms, had treatment, or took prescription medication at the time of or in a specified time prior to applying for coverage.

- Each Travel Medical Insurance for pre-existing medical conditions has a look-back period.

- Some conditions like the flu, shingles and arthritis may also be considered as pre-existing medical conditions depending on when the symptoms/illness began compared to the time of purchase. If an illness began during the look-back period, it is considered a pre-existing medical condition. These conditions will be covered by medical insurance plans for pre existing conditions.

Common Ailments Requiring Extra Costs

Here are some common ailments that travel insurance companies are likely to consider preexisting conditions, due to an increased risk level.

- Heart attack – A heart attack is caused by blood being cut off from the heart by a blockage in a vein or artery.

- Diabetes – Uncontrolled blood sugar levels can cause serious damage to your organs, as well as leading to possible blindness, amputations, and death.

- Flu – This respiratory illness typically circulates in the spring and fall months. It is accompanied by a fever, weakness, achiness all over, and can be fatal.

- Shingles – This is a reactivation of the measles virus. The rash is very painful and can occur anywhere, but is most common across the chest, back, and face.

- High Blood Pressure – It is caused when the heart pumps blood through the veins at higher than normal levels, damaging organs and may lead to a heart attack, stroke, aneurysm, and more.

- Arthritis – This starts out as being merely annoying, but the inflammation will deteriorate joints and is apt to grow increasingly painful. It may spread and cause neuropathy.

- High Cholesterol – Cholesterol is a naturally occurring fat that circulates in the veins. One kind can clog arteries and veins if not controlled, leading to possible heart attacks or strokes.

What Visitor Insurance for Medical Conditions Covers?

Visitor’s insurance is primarily for the purpose of providing treatment for new injuries or illnesses. It will cover medical problems that your own medical coverage will not cover.

A pre-existing condition may prevent you from receiving any money from the insurance company unless the policy covers the treatment of an “Acute Onset of Pre-existing Conditions”. Even when you have the coverage, the rules to obtain the benefit often limit what conditions will get covered and which will not. It is very important to understand what the policy will cover and what it will not before buying because the terms will vary from one company to the next. It is also a good idea to know what the costs may be for the treatment of your particular medical condition in that country.

As typically pre-existing conditions are not covered, you can buy visitor’s insurance the day before coverage is required and the policy can be emailed to you within a few hours of purchase.

Age is another factor to look into. Some visitor’s health insurance policies will provide good coverage for people under 70, but little for those who are older. Other companies will provide good coverage up to 90. If pregnant, be sure to understand the terms for coverage.

Before traveling, it is a good idea to understand what kind of medical expenses you may encounter if you have an emergency. While different medical conditions will require specialized treatments, some costs in the United States (at the Cleveland Clinic) that you need to be aware of include:

Coronary Care – $5,136 per day for Room and Board

Intensive Care – $5,136 per day for Room and Board

Medical/Surgical – $1,699 per day for Room and Board

Operating Room Charges – range from $2,071 to $3,903 per 30 minutes

Medical Scans – range from $100 to $4,793

Lab Charges – range from $20 to $942

Therapeutic Exercise – $193 per 15 min (does not include evaluation $480)

Visitor Insurance for Pre Existing Conditions: Look Back Period

The look-back period is considered in the case of visitor Insurance for pre existing conditions. It is a fixed amount of time the insurer will look back on to determine if a medical condition has been previously diagnosed. Usually the “look back” period can range from 180 days up to 2 years, depending on the plan/insurer. If a medical condition that was treated or symptoms were diagnosed existed in that timeframe it is considered a pre-existing medical conditions.

Typically, for Visitor Insurance for Pre Existing Conditions chronic illnesses like a heart condition, high blood pressure, diabetes, AIDS, pregnancy, cancer, etc. would be considered pre-existing medical conditions even if they do not fall in the look-back period, as they do not manifest overnight.

Many visitor’s health insurances and travel insurances automatically exclude pre-existing medical conditions. This means that a travel insurance plan will not cover the costs of treating a pre-existing medical condition and hence an insurance company can deny a claim arising from a pre-existing condition. In such cases you should specifically opt for health insurance that covers pre existing conditions.

How to get Visitor Insurance with Pre-existing Conditions?

Visitor Insurance with Pre Existing Conditions offers benefits for acute onset of pre-existing conditions. This means an insurer might not deny a claim for a pre-existing condition that is considered an acute onset and is as per the schedule of benefits. The majority of people traveling to the US who are above the age bar of 70 have one or multiple pre-existing medical conditions.

Insurance companies offer Visitor Insurance with Pre Existing Conditions, These include plans like the Patriot America Plus, and Atlas America. These medical insurance plans for pre existing conditions plans can cover the acute onset of a pre-existing condition up to the chosen policy maximum for individuals below the age of 70. But there are very limited plans that provide visitor insurance for pre-existing medical conditions over the 70s.

In order to get the best health insurance that covers pre existing conditions, you must check the pre-existing exclusion criteria as it can affect your insurance coverage. Visitor Guard® offers the best visitors insurance for parents from India with pre existing conditions.

Remember: Insurance companies can ask for medical records for up to five years prior, meaning you must disclose your pre-existing conditions in the event you use the insurance. It is advised to thoroughly read the insurance documents before purchasing visitor insurance for pre existing conditions.

What Medical Conditions affect Travel Insurance?

Conditions such as heart disease, cancer, high cholesterol, breathing conditions, kidney conditions, arthritis, stroke, epilepsy, liver conditions, or psychological conditions including depression, anxiety, and much more are considered pre-existing medical conditions by many. In such cases you should purchase health insurance that covers pre existing conditions.

Is High Blood Pressure a pre-existing medical condition?

High blood pressure or hypertension is a chronic condition and can contribute to other conditions. It is usually defined as a pre-existing condition for travel insurance applications. Safe Travels USA Comprehensive is a comprehensive medical insurance plan for pre existing conditions may be able to provide some coverage for an acute onset of a pre-existing condition.

Is Diabetes a pre-existing medical condition?

Yes, diabetes is usually defined as a chronic pre-existing condition. Purchasing health insurance that covers pre-existing conditionsSeeking a travel insurance cover for pre-existing medical conditions such as this will help the insured pay medical bills in case of an emergency. Safe Travel USA Comprehensive can provide some coverage for an acute onset of a pre-existing condition.

Is Stroke considered a pre-existing condition?

Yes, for health insurance that covers pre-existing conditions, like stroke is considered to be a pre-existing condition and excluded from coverage. It is always a good practice to read the certificate wording for the policy to understand chronic and non-chronic medical conditions are covered by medical insurance for pre existing conditions.

Visitor Insurance and Pre Existing Conditions

Pre-existing medical conditions like the ones described here, and many others, affect your travel insurance. If you take out cover, or you do not purchase a visitor insurance with plan pre-existing medical conditions coverage, you are effectively traveling uninsured for that health condition.

If any problems occur which are related to the pre-existing condition, then you will need to pay for them yourself.

Visitor Insurance for Pre Existing Conditions: Pregnancy

Pregnancy is often considered a pre-existing medical condition by many insurance providers. Many visitors to the US have various questions in regards to coverage for pregnancy and maternity-related expenses. The most commonly asked questions are:

Does Visitor Insurance cover Pregnancy?

An existing pregnancy is considered a pre-existing condition and is therefore not covered. Most Travel Medical Insurance to the US excludes benefits for maternity however you can consider a plan that can extend to treatment for complications of pregnancy. A limited amount of Visitor Health Insurance for Pre-existing Conditions do cover pregnancy. You need to look for the right insurance policy!

Can I claim travel insurance if pregnant?

Yes! You can generally claim for any unexpected complications of pregnancy (as per the schedule of benefits for that policy) when you are traveling under a visitor health insurance policy that includes cover for pregnancy. You can, however, claim for an eligible medical condition not related to pregnancy.

Review Safe Travel USA Comprehensive and Atlas America which are medical insurance plans for pre existing conditions and can provide limited coverage for complications due to pregnancy.

Who are the Best Travel Insurance Companies?

It’s difficult to answer that, as many insurance companies have a variety of excellent plans to cater to different needs. You want to find a plan that meets your needs (i.e. depending on your age, coverage time period, and need for coverage for pre-existing conditions or sports). Once you have a shortlist you can narrow them down. The underwriting company’s financial standing is another important criterion to look out for as they are the ones paying the claims. All the plans listed here on this site are underwritten by companies that have good to excellent financial ratings. If you have a pre-existing condition, it is good to be aware of the lookback period. Also, it is often helpful to talk to an insurance professional if you have questions regarding travel insurance for pre-existing medical conditions.

Quotes & Purchase

Tips for those Visiting the US with a Pre-existing Condition

- Get a comprehensive health check-up done before you leave home even if you are purchasing medical insurance for pre existing conditions and carry these medical records with you while traveling though not necessary to buy the insurance but a good practice to have it done so you can have the medical records in case of a claim.

- Bring medication to last twice the length of your trip. Be sure to plan ahead in case of delays with the flight.

- If your condition flares while in the US, give the attending doctor your complete history and your medical history. You can even carry your medical papers with you.

- If your claim regarding a non-pre-existing condition is denied, you can submit an appeal When you submit an appeal, you will have to write to the insurance substantiating why you think this claim needs to be paid along with supporting documents. These supporting documents typically are the medical records you have from the past health checks ups from your country and detailed records/letters from your doctor with whom you sought treatment.

- If the appeal is denied on the pre-existing condition exclusion clause, then it would be up to the insured to pay the bills. In such cases, it can be difficult for the insured to pay these high amounts. You can talk to the hospital/provider to see if there are any payment options or discounts that they offer so that the billed amount can be reduced. Hospitals typically do offer various options in such situations.

Atlas America Insurance

Looking for health insurance for your trip to the US? Apply now or get a free quote for visitors insurance through Visitor Guard® today!

Quotes & Purchase

Visitor Insurance for Pre Existing Conditions FAQ

To get a quote for Visitor Insurance for Pre Existing Conditions you will just need to enter your age, date and time of travel, number of days you will stay etc on the table at the top. Many plans include coverage for an acute onset of pre-existing condition. You can review more details in the brochure to find out which plan offers coverage for acute onset of nonchronic pre-existing conditions.

Generally high blood pressure, diabetes, heart disease, AIDS, pregnancy, cancer, cataract etc. would be considered pre-existing conditions. Typically, those illnesses or injuries would be considered preexisting if you are taking medication for or have seen a doctor for a medical consult before buying the medical insurance policy for pre existing conditions. Conditions that would not have occurred overnight after buying the insurance plan would typically be considered a preexisting condition

No, typically visitors health insurance plans do not cover preexisting conditions.However, there are certain health insurance plans that covers pre existing conditions. It is adviced to go through the brochure and choose the plan that serves your needs.

Yes, you can buy visitor medical insurance if you have a preexisting medical condition. The visitor’s medical insurance do not go through medical underwriting and hence anyone medical conditions are not evaluated.

However, you will have to check what the policy covers for an existing medical condition. Many policies provide coverage for an acute onset of a non-chronic preexisting condition. It is a good practice to review the brochure and understand what the policy covers.

An acute onset of a pre-existing condition is a sudden and unexpected outbreak or recurrence of a pre-existing condition which occurs spontaneously and without advance warning, either in the form of physician recommendations or symptoms. Treatment must be obtained within 24 hours of the sudden and unexpected outbreak or recurrence. Typically chronic and congenital conditions, complications or consequences of a chronic or congenital condition, or conditions that gradually become worse over time are excluded from coverage.

No, each plan will have exclusion on the policy. Pre-existing conditions are excluded under visitors health insurance. Many plans can provide coverage for an acute onset of non-chronic preexisting condition. Maternity is typically not covered under any policy.

More About Health Insurance that Covers Pre Existing Conditions

Tips for Visitor Insurance for Pre Existing Conditions